Our Firm

Our Firm

We create extraordinary value for our investors, partners, and communities alike.

Since its founding in 1996, Penzance has managed gross asset value of more than $4.4 billion in real estate through partnerships with blue-chip institutional investors, separate accounts, joint ventures, including our flagship discretionary fund series Penzance Real Estate Funds I and II.

We are proud of our deep roots in the region and focus our investment efforts on acquisition and development opportunities in multifamily, data center, industrial, and other commercial assets, where we leverage our operating platform and access to asymmetrical situational opportunities to produce outsized returns.

Our ability to source more than 50% of our investments off-market is a testament to our deep local relationships, experience, and proprietary sourcing methods which allow us to identify market inefficiencies.

Our Firm

Our Firm

We create extraordinary value for our investors, partners, and communities alike.

Since its founding in 1996, Penzance has managed gross asset value of more than $4.4 billion in real estate through partnerships with blue-chip institutional investors, separate accounts, joint ventures, including our flagship discretionary fund series Penzance Real Estate Funds I and II.

We are proud of our deep roots in the region and focus our investment efforts on acquisition and development opportunities in multifamily, data center, industrial, and other commercial assets, where we leverage our operating platform and access to asymmetrical situational opportunities to produce outsized returns.

Our ability to source more than 50% of our investments off-market is a testament to our deep local relationships, experience, and proprietary sourcing methods which allow us to identify market inefficiencies.

Investment Philosophy

At Penzance, a granular focus on operations and cross-departmental collaboration are the keys to unlocking value where others see obstacles. Our best-in-class team of subject matter experts in finance, engineering, development, and property and construction management, uses its market knowledge to uncover situational inefficiencies and find distressed and transitional assets, to which we apply our collective knowledge to repositioning and creating value.

Our strategy is to control and manage the full range of a property’s lifecycle and leverage our operational expertise to quickly and accurately underwrite and perform due diligence on new opportunities. This early stage of collaboration often yields unique value creation initiatives, creating cohesive organizational buy-in to the execution of our investment philosophy.

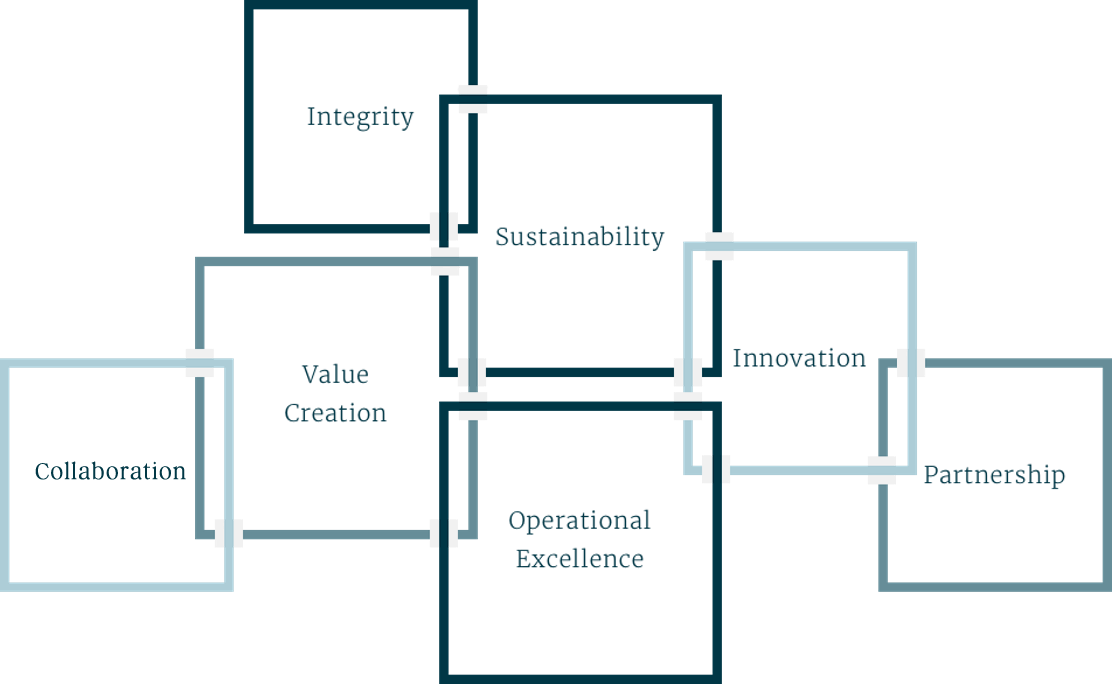

Values

Click or tap to reveal our values.

Integrity: Transparency and trust are fundamental to the way we do business. We are motivated by our partners’ success and core missions.

Sustainability: We aspire to be a leader and exemplar in sustainability in the industry with a focus on minimizing our environmental footprint within our portfolio.

Operational Excellence: With development, property, and asset management teams in-house, we have a fully collaborative team dedicated to creativity and reliable excellence.

Innovation: We specialize in creative solutions, allowing us to realize opportunities where others see obstacles.

Partnership: We seek out investors and partners who share our values, and we make their goals our own.

Value Creation: We recognize opportunity where others see obstacles and find common goals where others see conflict. Our integrated team is positioned to capitalize on market and asset inefficiencies to add significant value.

Collaboration: We prioritize collaborations with service providers and contractors who share our values.

Values define who we are and guide how we measure success.

Our Team

With fund management, acquisition, property management, asset management, leasing, construction, and development teams in-house, we have an integrated, collaborative team dedicated to creativity and excellence.

The Penzance team applies varied disciplines to every investment. This integrated approach means that from beginning to end, project components are controlled in-house, allowing for deeper insights to inform decision making.

We leverage the unique perspectives and experiences of our team members to find creative solutions, make better investment decisions, and achieve returns. Our extensive range of experiences sets us apart.

The Penzance team enjoying a Washington Spirit game with friends and family.

The Penzance team on a tour of the Capitol in the Fall of 2022.

Our Team

With fund management, acquisition, property management, asset management, leasing, construction, and development teams in-house, we have an integrated, collaborative team dedicated to creativity and excellence.

The Penzance team applies varied disciplines to every investment. This integrated approach means that from beginning to end, project components are controlled in-house, allowing for deeper insights to inform decision making.

We leverage the unique perspectives and experiences of our team members to find creative solutions, make better investment decisions, and achieve returns. Our extensive range of experiences sets us apart.

The Highlands was the second-largest multifamily property sale in 2022.

HC-81 was the Top 100 largest industrial property sale in 2022.

Pointe at New Town, a multifamily asset owned by Penzance and managed by Greystar, won Greystar’s 2022 Mid-Atlantic Community of the Year due to metrics such as average occupancy, tenant retention, reputation, and rent growth.

Penzance was the recipient of five awards at NAIOP’s 2022 Focus on Excellence event including Best Multifamily, Best Marketing, Best Transaction, Best Mixed Use, and Best Amenity. Click here to read more.

In November 2022, The Pierce at the Highlands received Delta Associates’ award for Best Overall Washington/Baltimore Condominium Community of 2022. The Evo won Best Northern Virginia High-Rise Apartment Community.

NAIOP, the commercial real estate development association, recognized 50 F’s leasing performance and its Washington, D.C. / Maryland chapter awarded the property with “Best Real Estate Transaction, Tenant Lease Under 20,000 Square Feet Pre-Built Suite Leasing” in October 2022.

Also in October, The Pierce won Best Print Advertising – Individual Ad, Associate from the Northern Virginia Building Association. (Click to view the ad)

In July 2022, the Highlands received the U.S. Green Building Council’s award for Innovative Residential Project of the Year.

In March 2022, the Highlands achieved LEED Gold certification for the entire 1.2 million square feet of the residential project; the Aubrey and Evo are among the first LEED Gold multi-family buildings in the region.

In February 2022, The Aubrey at the Highlands achieved LEED Gold Certification under the United States Green Building Council’s standards and has also been recognized as the first LEED Gold Certified multifamily project in the region under the new LEED V4 requirements.

In January 2022, STUDIOS Architecture received a DESIGNArlington Merit Award for the Aubrey at the Highlands. This award, like the Delta Associates award for the Aubrey in 2021, recognizes excellence in architecture, landscape design, and public art showcasing the best of the region.

In October 2021, the Aubrey at The Highlands received Delta Associates’ award for the Best Northern Virginia High-Rise Apartment Community. In 2021, Penzance was honored by NAIOP Northern Virginia when it chose to feature The Highlands project in Arlington, VA for its Development 101 Case Study Project. In 2019, The Highlands Project in Arlington, VA was honored by NAIOP with the Master Planned Project of the Year award, and in 2015, Penzance was honored by NAIOP Northern Virginia when it chose to feature the 3001/3003 Washington Blvd. project in Arlington, VA for its Development 101 Case Study Project.

Several Penzance properties have been awarded the Kingsley Excellence Award for buildings that outperform the Kingsley Index industry benchmark for overall tenant satisfaction. In 2024 and 2021, two of our properties received the award: Marker 20 in Herndon, VA and 50 F Street, NW, in Washington DC. In 2020, 4001 N. Fairfax Drive located in Arlington, VA, received the award, as did 1500 Wilson Blvd., also in Arlington and 1101 Connecticut Avenue, Washington, D.C, properties we managed at the time. In 2019, our property at 2000 14th North Street, in Arlington, VA received the award.

In May 2022, Peter N. Greenwald received the first annual Pinnacle Award from the Rosslyn Business Improvement District. The award recognizes his longstanding service and dedication to the Rosslyn community.

The Leadership Center for Excellence recognized John Kusturiss, III as a 40 under 40 Honoree in 2017.

In 2020, John E. Kusturiss, III was honored as the NAIOP NOVA Member of the year.

Cris White received the 40 Under 40 Rising Stars in Real Estate by DCA Live in 2017.

Penzance Memberships

Penzance is a member of the Apartment & Office Building Association of Metropolitan Washington, the local chapter for BOMI International.

Property Management team members (6) are candidates for the RPA through AOBA.

Penzance is a member of the Georgetown BID, Golden Triangle BID, Rosslyn BID, and Ballston BID.

Given their long-term and active presence in the DC Metro Area, the Executive Team members participate on many local boards. Senior professionals currently lead or participate with the following organizations: The Real Estate Roundtable, NAIOP / Commercial Real Estate Development Association, Urban Land Institute, DC Real Estate Group, Rosslyn Business Improvement District, Arlington Foundation for Arts and Innovation, Arlington Partnership for Affordable Housing, and the Virginia and District of Columbia Bar Associations.

Team Memberships

Peter N. Greenwald has chaired the Rosslyn (Arlington, VA) Business Improvement Corporation since 2011, and has been a member of its board of directors and executive committee since 2006. He served for two terms as a member of the Arlington Economic Development Commission, a County Board appointment.

John Kusturiss, III is a member of NAIOP and serves on the Board of Directors and Co-Chairs the Arlington Government subcommittee. He also serves on the Rosslyn BID Urban Design Committee.

Lauren Kowall is a member of NAIOP.

John Jacobsen is a member of ACREL (American College of Real Estate Lawyers).

Brandon Ripley is on the Board of Directors of the Associated Builders and Contractors (ABC) of Metro Washington and is also the Board Liaison to the Membership Committee.

Cris White is on the Montgomery College Foundation Board of Directors, Real Estate Committee.

Jeb Boland is on the board of NAIOP DC/MD and chairs the membership committee. He is also a member of CREBA and NAIOP VA.

Dean Neiman is a member of the Project Management Institute.

Deniz Babaoglu is a member of ULI.

Jeff Tidona is a member of the ULI Young Leaders Group.

Heather Rosenblum is a member of the ULI Young Leaders Group.

Jordan Steck is a member of the ULI Young Leaders Group.

Peter Titus is a member of the Design-Build Institute of America, Washington Building Congress, Associated Builders and Contractors (ABC) of Metro Washington.

Amin BouHabib is a member of Virginia Society of Certified Public Accountants (VSCPA).

Certifications

Richard Brookshire is a Chartered Alternative Investment Analyst (CAIA), a professional designation granted by the Chartered Alternative Investment Analyst Association, founded by The Alternative Investment Management Association (AIMA) and The Center for International Securities and Derivatives Markets (CISDM).

Rickey Williams holds a Project Management Professional (PMP) certification.

Jackie Jawitz is an active member of the American Institute of Certified Public Accountants and a Certified Public Accountant.

Hunter Mezzetti is a Certified Public Accountant.

Natalie McClung is a Certified Public Accountant.

Amin BouHabib is a Certified Public Accountant.

Philip Remson is a BOMI Facilities Management Administrator.

Our Firm

Our Firm